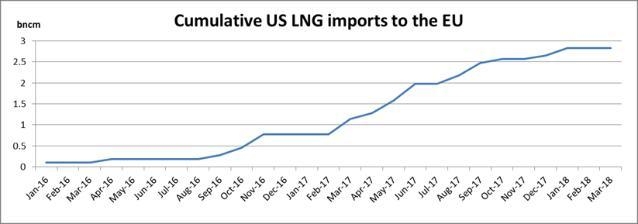

Since the arrival of the first U.S. LNG carrier in the Portuguese port of Sines April 2016 and today, EU imports of liquefied natural gas from the U.S. have increased from zero to 2.8 billion cubic meters.

In their Joint Statement of 25 July in Washington D.C., President Juncker and President Trump agreed to strengthen EU-U.S. strategic cooperation with respect to energy. In this context, the European Union would import more liquefied natural gas from the United States to diversify and render its energy supply more secure. The EU and the U.S. will therefore work to facilitate trade in liquefied natural gas.

European Commission President Jean-Claude Juncker said: "The European Union is ready to facilitate more imports of liquefied natural gas from the U.S. and this is already the case as we speak. The growing exports of U.S. liquefied natural gas, if priced competitively, could play an increasing and strategic role in EU gas supply; but the U.S. needs to play its role in doing away with red tape restrictions on liquefied natural gas exports. Both sides have much to gain by working together in the energy field."

Commissioner for Climate Action and Energy, Miguel Arias Cañete, said: "Diversification is an important element for ensuring the security of gas supply in the EU. Increasing imports of competitively priced liquefied natural gas from the U.S. is therefore to be welcomed. This is happening at a time when EU indigenous gas production is declining more rapidly than foreseen and there is an accelerated phase-out of coal power plants in the EU."

The EU has co-financed or committed to co-finance LNG infrastructure projects worth over €638 million (see list of projects in Annex 2). In addition to the existing 150 billion cubic meters of spare capacity in the EU, the EU is supporting 14 liquefied natural gas infrastructure projects, which will increase capacity by another 15 billion cubic meters by 2021, which could welcome imports of liquefied natural gas from the U.S., if the market conditions are right and prices competitive.

Currently, U.S. legislation still requires prior regulatory approval for liquefied natural gas exports to Europe. These restrictions need to be addressed and U.S. rules made easier for U.S. liquefied natural gas to be exported to the EU.

Presidents Juncker and Trump set up an Executive Working Group at their meeting in Washington, D.C. on 25 July. Since then contacts have taken place between Presidents Juncker and Trump, between EU Trade Commissioner Malmström and U.S. Trade Representative Lighthizer, and between the senior advisers of President Juncker and President Trump (Commission Secretary-General Martin Selmayr and White House Chief Economic Adviser Larry Kudlow).

It has been agreed that on 20 August the Trade Adviser of President Juncker and a senior EU trade official will travel to Washington, D.C. to meet their U.S. counterparts to continue work on implementing the Joint Statement. In this context, the EU and the U.S. are working within the framework of this Executive Working Group to increase U.S. exports of liquefied natural gas to Europe.

Background

The global liquefied natural gas market is becoming increasingly fluid and competitive. Between 2017 and 2023, global liquefied natural gas trade is expected to grow by more than 100 billion cubic meters, from 391 to 505[1]. The International Energy Agency expects liquefied natural gas imports to Europe to increase by almost 20% by 2040 compared to 2016 levels.

The increasing gas production in the U.S. and the start of U.S. liquefied natural gas exports to the EU in 2016 have improved the security of gas supply in Europe and globally. Europe is currently importing around 70% of the gas it needs, and this share is expected to increase in the coming years. Liquefied natural gas is also an important part of the EU's diversification strategy; and as the second biggest single gas market in the world after the U.S., the EU is therefore an attractive option for the U.S.

In order to increase imports to Europe further, U.S. prices for liquefied natural gas need to be competitive on the EU market. In addition, the following actions are key to facilitating imports:

Development of liquefied natural gas capacities in the EU and in the U.S.:

- Development of liquefied natural gas capacities in the EU and in the U.S.:

The EU has well developed liquefied natural gas import capacities, with about 150 billion cubic meters currently spare. At the same time, given their strategic importance for diversification, current capacities are being expanded and new capacities are being developed in the Adriatic Sea (on the island of Krk in Croatia), in the Baltic Sea, notably in Poland, and in the Mediterranean Sea in Greece. This would allow for a significant increase of liquefied natural gas imports to the EU.

The U.S. currently has 28 billion cubic meters of liquefaction capacity and is foreseen to add a further 80 billion cubic meters by 2023, while expanding its liquefied natural gas export terminals.

- Regulatory restrictions by the U.S. need to be lifted. The EU has no non-market barriers for U.S. natural gas coming to the EU. The EU is seeking similar treatment from the U.S. side, in particular as regards the removal of the requirement for prior approval of liquefied natural gas exports to the EU.

The current figures show that imports of U.S. liquefied natural gas to the EU have been increasing:

- Since the first shipment of U.S. liquefied natural gas to the EU in April 2016, today EU imports of liquefied natural gasfrom the United States have already reached 2.8 billion cubic meters (bcm).

- Since early 2016, the EU has received more than 40 liquefied natural gas cargoes from the U.S. In 2017 Europe represented more than 10% of total U.S. liquefied natural gas exports, up from 5% in 2016.

For more information

Liquefied Natural Gas (LNG) – background

ANNEX

1. EU imports of Liquefied Natural Gas from the United States

2. EU support to Liquefied Natural Gas capacities

|

LNG terminals built in 2013-2018 |

|

|

|

|

|

Member State |

Terminal |

Year of start-up |

Capacity (bcm/y) |

EU co-financing |

|

Italy |

FSRU OLT Oshore LNG Toscana |

2013 |

3.8 |

|

|

Lithuania |

FSRU Independence |

2014 |

4.0 |

€27.4m (CEF) for connecting pipelines |

|

France |

Dunkerque LNG Terminal |

2016 |

13.0 |

|

|

Poland |

Swinoujscie LNG Terminal |

2016 |

5.0 |

€130m awarded (EEPR) €202m (ERDF) €332m in total |

|

Malta |

Malta Delimara LNG terminal |

2017 |

0.7 |

€0.7m for studies (CEF) |

|

|

|

|

|

|

|

LNG terminals under construction |

|

|

|

|

|

Member State |

Terminal |

Year of start-up |

Capacity (bcm/y) |

EU co-financing |

|

Greece |

Revithoussa LNG Terminal (capacity extension) |

2018 |

2.0 (from 5.0 to 7.0) |

€50.8m (ERDF) |

|

Spain |

Tenerife (Arico-Granadilla) LNG terminal |

2021 |

1.3 |

|

|

Spain |

Gran Canaria (Arinaga) LNG terminal |

2022 |

1.3 |

|

|

|

|

|

|

|

|

LNG terminals on the Projects of common Interest (PCI) list |

|

|

|

|

|

Member State |

Terminal |

Year of start-up |

Capacity (bcm/y) |

EU co-financing |

|

Croatia |

Krk LNG terminal |

2019 |

2.6 |

€108m (CEF) for the terminal €16m (CEF) for evacuation pipeline €124m in total |

|

Greece |

LNG terminal in Northern Greece |

2020 |

5.5 |

€2m (CEF) for studies

|

|

Cyprus |

Cyprus LNG terminal |

2020 |

|

€101.2m (CEF) |

|

Sweden |

Gothenburg LNG terminal |

2021 |

0.5 |

|

|

Poland |

Świnoujście LNG terminal (capacity extension) |

2022 |

2.5 (from 5.0 to 7.5) |

|

|

Ireland |

Shannon LNG Terminal |

2022 |

6.2 |

|

CEF: Connecting Europe Facility

EEPR: European Energy Programme for Recovery

ERDF: European Regional Development Fund

PCI: Projects of Common Interest

[1]Source: International Energy Agency.